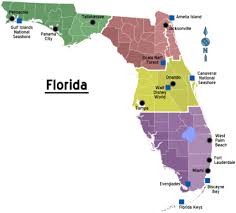

Auto Insurance Rates in FL Vary Significantly by Zip Code

Brevardtimes.com reported today1 that there are disparities in the premiums being paid by auto insurance based on your zip code in Florida with Miami residents paying up to $2632 and the lowest was reported to be $1043 in Gainseville.

Brevardtimes.com reported today1 that there are disparities in the premiums being paid by auto insurance based on your zip code in Florida with Miami residents paying up to $2632 and the lowest was reported to be $1043 in Gainseville.

The averages reported are based on insurance for a single 40-year-old male driver of a 2012 Honda Accord with a clean record and good credit who commutes 12 miles to work each day, with policy limits of 100/300/50 ($100,000 for injury liability for one person, $300,000 for all injuries and $50,000 for property damage in an accident) and a $500 deductible on collision and comprehensive coverage. "This highlights the need for independent agents to use a comparative rater.

With increasing economic pressures that everyone is facing these days, you can be sure that ...Read More

On July 4, 2013 the Chicago Tribune reported that IL is set to raise

On July 4, 2013 the Chicago Tribune reported that IL is set to raise  The Albany Democrate-Herald reported today that Mobile Apps that show proof of insurance are now accepted in New York and 23 other states. The article mentions that users of the electronic option of proof of insurance are generally under 40.

The Albany Democrate-Herald reported today that Mobile Apps that show proof of insurance are now accepted in New York and 23 other states. The article mentions that users of the electronic option of proof of insurance are generally under 40.  It was reported this week by Reuters that Low-income earners are being priced out of the market for auto insurance because occupation and education are taken into account by underwriters.

It was reported this week by Reuters that Low-income earners are being priced out of the market for auto insurance because occupation and education are taken into account by underwriters.  As we see summer come to an end the Seattle Times published a fantastic article that can help us weed through the insurance uncertanties of renting a car. Nobody wants to spend money unnecessarily, but nobody wants to be exposed as well. The article can be read here:

As we see summer come to an end the Seattle Times published a fantastic article that can help us weed through the insurance uncertanties of renting a car. Nobody wants to spend money unnecessarily, but nobody wants to be exposed as well. The article can be read here: State minimum insurance may not be the ideal choice for you. Take this story:

State minimum insurance may not be the ideal choice for you. Take this story: Are you a parent or a guardian of a teen who is seeking to buy cheap car insurance for teens? If you are, you have no reason to worry anymore. It is no secret that purchasing auto insurance for teen drivers is an expensive adventure.

Are you a parent or a guardian of a teen who is seeking to buy cheap car insurance for teens? If you are, you have no reason to worry anymore. It is no secret that purchasing auto insurance for teen drivers is an expensive adventure.  Car insurance is the law and not an option. Knowing car insurance is mandatory is just the first step in what should be a serious process of comparing auto insurance policies and selecting the right one for your needs.

Car insurance is the law and not an option. Knowing car insurance is mandatory is just the first step in what should be a serious process of comparing auto insurance policies and selecting the right one for your needs. Don't you wish you could predict the future, especially when it came to car accidents? We could all just stay home and not drive that day. We certainly wouldn't have to buy car insurance because we would never be an accident!

Don't you wish you could predict the future, especially when it came to car accidents? We could all just stay home and not drive that day. We certainly wouldn't have to buy car insurance because we would never be an accident! Obtaining car insurance can be a complicated and frustrating process at times. But there are some great resources available which can help you to find the best coverage for your needs at a competitive price. The steps involved in doing so are pretty simple as well. Let’s explore this further.

Obtaining car insurance can be a complicated and frustrating process at times. But there are some great resources available which can help you to find the best coverage for your needs at a competitive price. The steps involved in doing so are pretty simple as well. Let’s explore this further. It is likely that you have, or will be involved in a car accident. A car accident is not something you want to have, but inevitably you may find yourself involved in one.

It is likely that you have, or will be involved in a car accident. A car accident is not something you want to have, but inevitably you may find yourself involved in one.  The Insurance Journal reported on January 13, 2014 that a Pennsylvania law is set to take effect that will allow state residents to show their proof of auto insurance electronically using mobile devices during a traffic stop. Pennsylvania joins 29 other states including Arkansas, California, Florida, Georgia, Illinois, Indiana, Missouri and Texas who already accept electronic proof of insurance. The article can be read in its entirity here: http://www.insurancejournal.com/magazines/features/2014/01/13/316323.htm

The Insurance Journal reported on January 13, 2014 that a Pennsylvania law is set to take effect that will allow state residents to show their proof of auto insurance electronically using mobile devices during a traffic stop. Pennsylvania joins 29 other states including Arkansas, California, Florida, Georgia, Illinois, Indiana, Missouri and Texas who already accept electronic proof of insurance. The article can be read in its entirity here: http://www.insurancejournal.com/magazines/features/2014/01/13/316323.htm Finding the right auto insurance does not have to be hard. The trick is to become knowledgeable on what options you have and then make an informed decision. Here are a few tips to help you do that.

Finding the right auto insurance does not have to be hard. The trick is to become knowledgeable on what options you have and then make an informed decision. Here are a few tips to help you do that. Everyone loves to save money on all kinds of products and services. The same holds true for car insurance. So we will discuss how to find cheap car insurance.

Everyone loves to save money on all kinds of products and services. The same holds true for car insurance. So we will discuss how to find cheap car insurance. Car insurance was something which most people knew they had to get but generally understood little about it. The advent of the Internet has changed this and it is now possible for people to easily compare coverage and cost of car insurance online. If you would like to take advantage of the resources found on the Internet, here are some suggestions.

Car insurance was something which most people knew they had to get but generally understood little about it. The advent of the Internet has changed this and it is now possible for people to easily compare coverage and cost of car insurance online. If you would like to take advantage of the resources found on the Internet, here are some suggestions. You have probably noticed that many companies advertise that they offer cheap auto insurance. Everyone wants to save money on their coverage but make certain that if you consider cheap auto insurance, it can provide you with adequate coverage from a reputable company. Here’s a suggestion which is a great option.

You have probably noticed that many companies advertise that they offer cheap auto insurance. Everyone wants to save money on their coverage but make certain that if you consider cheap auto insurance, it can provide you with adequate coverage from a reputable company. Here’s a suggestion which is a great option.