Are you covered in a rental?

As we see summer come to an end the Seattle Times published a fantastic article that can help us weed through the insurance uncertanties of renting a car. Nobody wants to spend money unnecessarily, but nobody wants to be exposed as well. The article can be read here:

As we see summer come to an end the Seattle Times published a fantastic article that can help us weed through the insurance uncertanties of renting a car. Nobody wants to spend money unnecessarily, but nobody wants to be exposed as well. The article can be read here:

http://seattletimes.com/html/travel/2021513427_rentalcarinsurancexml.html

Chris Albu said, "This reinforces the role of the independent agent.

You can use your agent as a resource, as a partner, rather than simply someone who you buy insurance from."

Albu's company, QuotePro, is the leader in software that facilitates sales of auto insurance. "Remember that insurance laws and regulations change from state to state, so be sure to consult your insurance agent."Read More

It was reported this week by Reuters that Low-income earners are being priced out of the market for auto insurance because occupation and education are taken into account by underwriters.

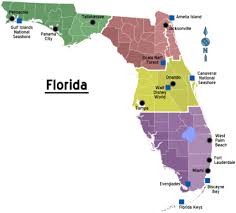

It was reported this week by Reuters that Low-income earners are being priced out of the market for auto insurance because occupation and education are taken into account by underwriters.  Brevardtimes.com reported today1 that there are disparities in the premiums being paid by auto insurance based on your zip code in Florida with Miami residents paying up to $2632 and the lowest was reported to be $1043 in Gainseville.

Brevardtimes.com reported today1 that there are disparities in the premiums being paid by auto insurance based on your zip code in Florida with Miami residents paying up to $2632 and the lowest was reported to be $1043 in Gainseville.  On July 4, 2013 the Chicago Tribune reported that IL is set to raise

On July 4, 2013 the Chicago Tribune reported that IL is set to raise  Illinois is now poised to raise mandatory auto insurance minimums. An article in the Chicago Tribune on May 28th reported, "

Illinois is now poised to raise mandatory auto insurance minimums. An article in the Chicago Tribune on May 28th reported, " State minimum insurance may not be the ideal choice for you. Take this story:

State minimum insurance may not be the ideal choice for you. Take this story: The Albany Democrate-Herald reported today that Mobile Apps that show proof of insurance are now accepted in New York and 23 other states. The article mentions that users of the electronic option of proof of insurance are generally under 40.

The Albany Democrate-Herald reported today that Mobile Apps that show proof of insurance are now accepted in New York and 23 other states. The article mentions that users of the electronic option of proof of insurance are generally under 40.  Chicago-based QuotePro has announced their expansion into 38 States with their Retail Website Solution. Quotepro Technology allows online consumers to price shop and purchase Auto Insurance 24/7/365.

Chicago-based QuotePro has announced their expansion into 38 States with their Retail Website Solution. Quotepro Technology allows online consumers to price shop and purchase Auto Insurance 24/7/365. The San Antonion Business Journal reported today that teen drivers drive up their parents' auto insurance premiums by 71% (

The San Antonion Business Journal reported today that teen drivers drive up their parents' auto insurance premiums by 71% (