Performance High for Independent Insurance Agents

Reagan Consulting reported in the Insurance Journal on February 11, 2014 that Independent Insurance Agents posted new highs for profitability and growth in the 4th quarter of 2013. This was derived from a survey of several large and mid-sized agencies. Median organic growth was 6.2%. The article's author wondered if this profitability can be sustained. The article can be read in its entirety here: http://www.insurancejournal.com/news/national/2014/02/11/320109.htm?utm_campaign=Social%20Media%20Posts&utm_source=linkedin&utm_medium=social&utm_content=4229895

Independent agencies who use QuotePro's Technology have enjoyed a new sales distribution channel. QuotePro's baseline technology, the Comparative Rater, powers agency websites to SELL auto insurance. This keeps the agency open 24/7 by facilitating online sales of Auto Insurance without agent intervention. Additionally, QuotePro can enable agency websites t...Read More

Arbella Insurance has been recognized for their innovativation in Auto Insurance Sales by Best Review. In an announcement posted on Arbella's website, the insurance carrier was given praise for their Carpartment program that serves as a starter package for young adults. The website posting goes on to say that young adults comprise a large demographic, many of whom are being left out of the insurance conversation. While most adults have auto insurance, only about 30% of those in rental housing have rental insurance. You can read the article in its entirity here: http://www.arbella.com/arbella-insurance/why-arbella/news-and-media/best-review-recognizes-arbella

Arbella Insurance has been recognized for their innovativation in Auto Insurance Sales by Best Review. In an announcement posted on Arbella's website, the insurance carrier was given praise for their Carpartment program that serves as a starter package for young adults. The website posting goes on to say that young adults comprise a large demographic, many of whom are being left out of the insurance conversation. While most adults have auto insurance, only about 30% of those in rental housing have rental insurance. You can read the article in its entirity here: http://www.arbella.com/arbella-insurance/why-arbella/news-and-media/best-review-recognizes-arbella Steve Daniels of Crains Chicago Business reported on January 8, 2014 that auto insurance rates are set to rise up to 4% for GEICO, Allstate, American Family and eSurance in 2014. Increases are not set for Progressive and State Farm, who increased their rates in Illinois in 2013. According to the article, State Farm is by far the largest auto insurer in Illinois and Progressive is #3.

Steve Daniels of Crains Chicago Business reported on January 8, 2014 that auto insurance rates are set to rise up to 4% for GEICO, Allstate, American Family and eSurance in 2014. Increases are not set for Progressive and State Farm, who increased their rates in Illinois in 2013. According to the article, State Farm is by far the largest auto insurer in Illinois and Progressive is #3. On January 28, 2014 the Insurance Journal reported that the Massachusetts Immigrant and Refugee Advocacy Coalition, or MIRA, is attempted to change the law that requires one to be a resident of Massachusetts to obtain a drivers license. MIRA argues that the roads would be safer should immigrants become licensed because they would be trained & insured. You can read the article in its entirety here:

On January 28, 2014 the Insurance Journal reported that the Massachusetts Immigrant and Refugee Advocacy Coalition, or MIRA, is attempted to change the law that requires one to be a resident of Massachusetts to obtain a drivers license. MIRA argues that the roads would be safer should immigrants become licensed because they would be trained & insured. You can read the article in its entirety here:  Yes! You can buy auto insurance online. In Illinois, Indiana, Texas, Missouri, California and other states it is possible to buy state minimum coverage, liability only and full coverage auto insurance from multiple carriers on several insurance agency websites. Websites powered by QuotePro have long enjoyed the ability to Bind converage Online without agent intervention. This allows the independent agent to use the same tools as giant companies use online to gain new customers.

Yes! You can buy auto insurance online. In Illinois, Indiana, Texas, Missouri, California and other states it is possible to buy state minimum coverage, liability only and full coverage auto insurance from multiple carriers on several insurance agency websites. Websites powered by QuotePro have long enjoyed the ability to Bind converage Online without agent intervention. This allows the independent agent to use the same tools as giant companies use online to gain new customers. It was reported in The Insurance Journal today that Confie Seguros, a leading provider of insurance services nationwide, has announced that they have acquired Ida Tunnel Insurance in Marble Falls, TX.

It was reported in The Insurance Journal today that Confie Seguros, a leading provider of insurance services nationwide, has announced that they have acquired Ida Tunnel Insurance in Marble Falls, TX.  The Ahwatukee Foothills News reported that new legislation sponsored by Rep. Ethan Orr (R-Tucson) would raise the state minimum auto insurance from $15,000 to $25,000 for individuals injured. Similarly, coverage for injuries to multiple victims in any one mishap would have to go from $30,000 to $50,000. The move comes after 42 years of the same level of minimum insurance and hopes to offer a more realistic scenario on what this level will cover. This is a trend seen in Illinois, Indiana, Texas, California and in other states. Please click

The Ahwatukee Foothills News reported that new legislation sponsored by Rep. Ethan Orr (R-Tucson) would raise the state minimum auto insurance from $15,000 to $25,000 for individuals injured. Similarly, coverage for injuries to multiple victims in any one mishap would have to go from $30,000 to $50,000. The move comes after 42 years of the same level of minimum insurance and hopes to offer a more realistic scenario on what this level will cover. This is a trend seen in Illinois, Indiana, Texas, California and in other states. Please click  PropertyCasualty360.com reported yesterday on the most expensive cars to insure. You can see the article in its entirety at http://www.propertycasualty360.com/2014/03/11/20-most-expensive-2014-model-cars-to-insure. The article illustrates the need for an independent insurance agent to offer you the cheapest rate available - whether you buy auto insurance in Chicago, IL or if you buy auto insurance in Los Angeles, CA. A local agent can offer you the best policy for your car and budget.

PropertyCasualty360.com reported yesterday on the most expensive cars to insure. You can see the article in its entirety at http://www.propertycasualty360.com/2014/03/11/20-most-expensive-2014-model-cars-to-insure. The article illustrates the need for an independent insurance agent to offer you the cheapest rate available - whether you buy auto insurance in Chicago, IL or if you buy auto insurance in Los Angeles, CA. A local agent can offer you the best policy for your car and budget. Carrier Management announced today that ACUITY topped the list of the Top 10 P/C Performers after consultants for Deep Customer Connections, specialists in insurance carrier and insurance agent consulting, complied results of a 7000 agent survey conducted in 2013. The Sheboygan, WI insurer ACUITY led the group. You can read the article in its entirety here: http://www.carriermanagement.com/news/2014/01/08/117428.htm

Carrier Management announced today that ACUITY topped the list of the Top 10 P/C Performers after consultants for Deep Customer Connections, specialists in insurance carrier and insurance agent consulting, complied results of a 7000 agent survey conducted in 2013. The Sheboygan, WI insurer ACUITY led the group. You can read the article in its entirety here: http://www.carriermanagement.com/news/2014/01/08/117428.htm The traditional way of getting auto insurance was to contact an insurance agent who would then take your application and eventually quote you rates for a policy. But with the advent of the Internet, it is now possible to research, shop and evaluate and purchase coverage all from an integrated website. So let’s look at the pros and cons of using such a site.

The traditional way of getting auto insurance was to contact an insurance agent who would then take your application and eventually quote you rates for a policy. But with the advent of the Internet, it is now possible to research, shop and evaluate and purchase coverage all from an integrated website. So let’s look at the pros and cons of using such a site. The San Antonion Business Journal reported today that teen drivers drive up their parents' auto insurance premiums by 71% (

The San Antonion Business Journal reported today that teen drivers drive up their parents' auto insurance premiums by 71% ( Car insurance is something that every person must purchase if they are to be allowed to operate a motor vehicle. This law was put in place to cover people’s financial liability, so that any injuries or damages could be immediately paid for. Most people don’t have thousands of dollars sitting around, so this system is a great way to protect someone’s financial liability. However, it can become very expensive if you aren’t careful.

Car insurance is something that every person must purchase if they are to be allowed to operate a motor vehicle. This law was put in place to cover people’s financial liability, so that any injuries or damages could be immediately paid for. Most people don’t have thousands of dollars sitting around, so this system is a great way to protect someone’s financial liability. However, it can become very expensive if you aren’t careful. Searching for auto insurance online options is relatively easy to do. A quick search on Google will reveal a wide selection of websites which offer car insurance quotes for free. However, considering how most online car insurance sites are now automated, getting a free quote on the internet isn't particularly hard to do.

Searching for auto insurance online options is relatively easy to do. A quick search on Google will reveal a wide selection of websites which offer car insurance quotes for free. However, considering how most online car insurance sites are now automated, getting a free quote on the internet isn't particularly hard to do.  Many people in these tough economic times are upset because of the amount of money they spend annually insuring their vehicles. Perhaps you are one of them. Don't be upset anymore because this article takes you through several tips you can follow to save some cash on car insurance.

Many people in these tough economic times are upset because of the amount of money they spend annually insuring their vehicles. Perhaps you are one of them. Don't be upset anymore because this article takes you through several tips you can follow to save some cash on car insurance. Car insurance is an important way to protect your vehicle and occupants from the risk of an accident. But the cost always seems to be higher than you would otherwise like it to be. But here are some good tips to help you to save money on car insurance.

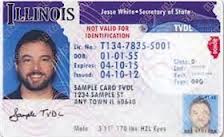

Car insurance is an important way to protect your vehicle and occupants from the risk of an accident. But the cost always seems to be higher than you would otherwise like it to be. But here are some good tips to help you to save money on car insurance. A bond card can be used instead of your driver’s license if a police officer tickets you and requests that you surrender your drivers license. This way you are not without your valuable proof of identity which you need for access to office buildings, travel and when cashing checks and using credit cards.

A bond card can be used instead of your driver’s license if a police officer tickets you and requests that you surrender your drivers license. This way you are not without your valuable proof of identity which you need for access to office buildings, travel and when cashing checks and using credit cards. There are many factors which can affect the rate that a person pays for car insurance. For many people this can be pretty confusing. But there are some effective ways to compare rates in order to better understand the kind of coverage a person is receiving as well as help to find a cost effective option. Let’s discuss some ways to do so.

There are many factors which can affect the rate that a person pays for car insurance. For many people this can be pretty confusing. But there are some effective ways to compare rates in order to better understand the kind of coverage a person is receiving as well as help to find a cost effective option. Let’s discuss some ways to do so.